More fish but less money for AquaBounty in Q2

GM salmon farmer’s losses increased due to lower prices and higher costs

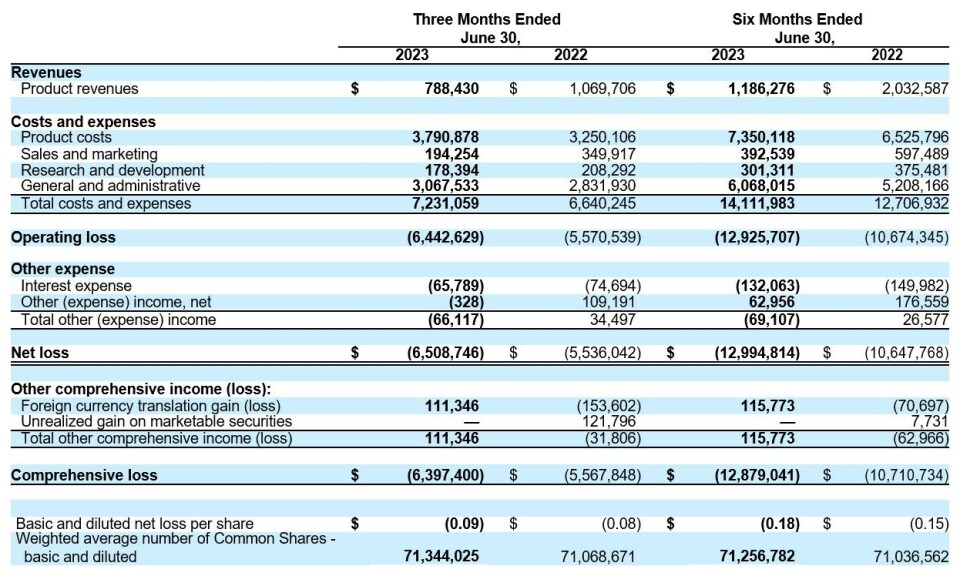

US land-based salmon farmer AquaBounty generated lower revenues in the second quarter of 2023 compared to the same period in 2022, and year-on-year losses increased by US $1 million.

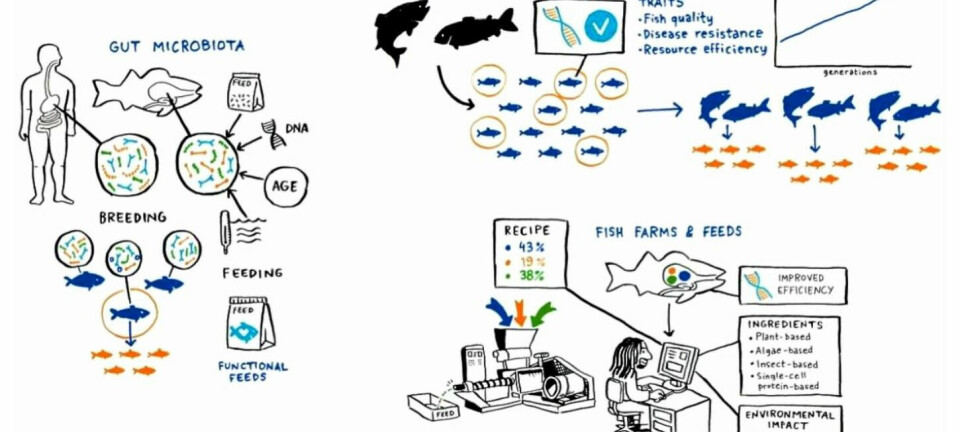

AquaBounty, which produces Atlantic salmon with an inherited genetic modification that makes them grow more quickly, made product revenue of €788,000 from April to June, a decrease of 26% compared to the $1.1m made in Q2 2022.

Net loss in the second quarter of 2023 was $6.5m, up from $5.5m in Q2 2022.

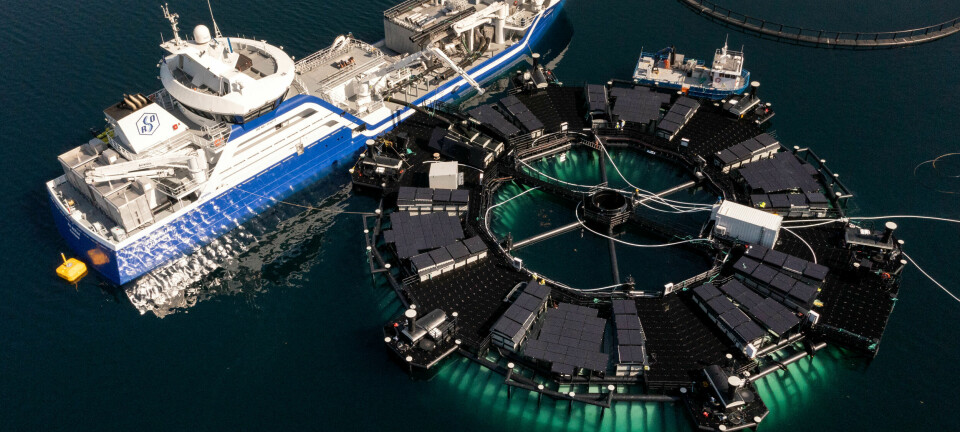

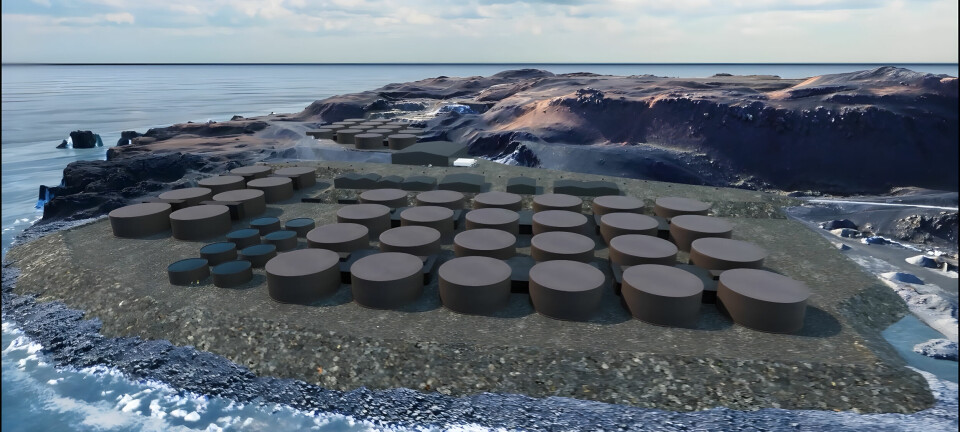

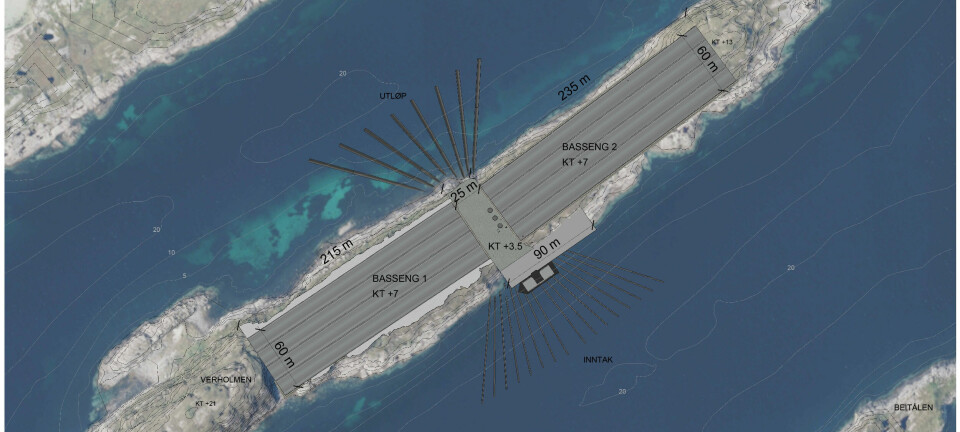

The company grows its fish in a 1,200-tonne recirculating aquaculture system (RAS) facility in Albany, Indiana, and is building a 10,000-tonne-plus facility in Pioneer, Ohio.

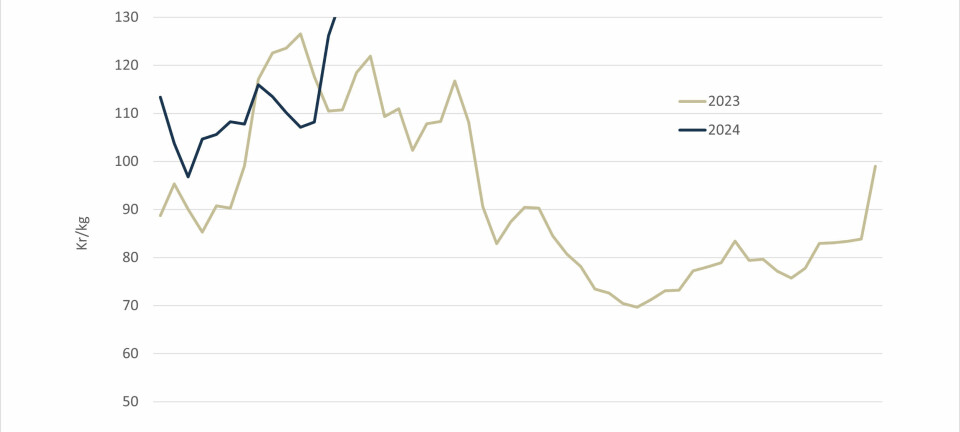

Price decline

“Our second quarter results were impacted by a significant decline in market prices for Atlantic salmon, despite the fact that our Indiana farm had its highest quarterly output to date,” said AquaBounty chief executive Sylvia Wulf in a press release today. “The demand for our fish continues to exceed our supply and we continue to identify opportunities to increase our production to meet this demand.

“We announced in early June that the Company was pausing the construction of our farm in Pioneer, Ohio, due to a substantial increase in its estimated cost of completion. The Company is currently evaluating both the cost estimate and our options for moving forward, including alternative financing solutions to bring the project to completion. We previously announced our entry into a contractual commitment with a new construction firm who is assisting us in evaluating construction costs and who would lead construction of the facility going forward.

Egg production

“Progress continues on the expansion of our broodstock and egg production capabilities at our farm on Prince Edward Island; and we continue to explore new business development opportunities which leverage our core strengths, and which could be applied to new species, including conventional salmon and other finfish, and new geographical territories worldwide.”

AquaBounty’s revenue for the first half of 2023 was $1,186,276, down from $2,032,587 in H1 2022, when salmon prices were at record highs. The company’s net loss for H1 2023 was $12,994,814, up from $10,647,768 in the first half of 2022.

In its Q2 report, AquaBounty said rising costs had hurt its bottom line.

“Recently elevated global inflation rates continue to impact all areas of our business. We are experiencing higher costs for farming supplies, transportation costs, wage rates, and other direct operating expenses, as well as for capital expenditures related to the construction of our farm in Ohio,” stated the company.

“We expect inflation to continue to negatively impact our results of operations for the near-term.”